Can An Employee Be Exempt From Social Security Tax

Am I Exempt from Social Security Tax Withholding. Contributions made to a 401k individual retirement account IRA or savings incentive match plan for employees SIMPLE IRA are exempt from federal income tax.

Income Limit For Maximum Social Security Tax 2021 Financial Samurai

Roth 401k and Roth IRA plans are taxable to federal income tax.

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Can an employee be exempt from social security tax. Employees of foreign governments are generally exempt from paying Social Security taxes on income paid to them as a result of their official responsibilities. And exempt on W-4 does not automatically apply to state and local income taxes. As long as the foreign government employee is working in an official capacity on official business related to his employment he does not have to pay Social Security on his pay.

Anything you earned over this threshold is exempt from Social Security tax. The Social Security exemption does not apply to servants of. The federal government allows several categories of employment and employee status to be exempt from FICA and the specific details that define which employers and employees fit these categories may be determined slightly differently by state.

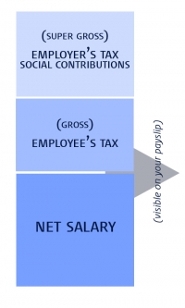

Social Security Taxes Even if an employee is exempt from income taxes he is not exempt from paying Social Security or Medicare taxes. The current rate is a 62 tax on both the employee and employer for a total of 124. Currently the Social Security tax is 124 half of which is paid by the employer with the other 62 paid by the worker through payroll withholding.

Employees of international organizations are exempt from Social SecurityMedicare taxes on wages paid to them for services performed within the United States in their official capacity as employees of such organizations. However there are some employees. When you have a tax-exempt employee do not withhold any federal income tax from their wages.

Claiming exempt on W-4 does not mean an employee is exempt from Social Security and Medicare taxes. Information about Form 4029 Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits including recent updates related forms and instructions on how to file. Employer contributions are usually exempt from all taxes including Social Security and Medicare.

If your wages were more than 137700 in 2020 multiply 137700 by 62 to arrive at the amount you and your employer must each pay. Thus you cannot withhold income taxes from his paycheck but you should still withhold Social Security and Medicare taxes from each check. Form 4029 is used by religious group members to apply for exemption from Social SecurityMedicare taxes.

If youre a temporary foreign student professor teacher or another certain educational worker you may be exempt from paying Social Security. If both the employer and the employee belong to a qualified religion banning insurance wages are exempt from Social Security taxes but the exemption does not apply if only one party belongs to. There are exceptions though.

High-income employees are not technically exempt from Social Security taxes but part of their income is. For Medicare that tax is a combined 29. Most workers have payroll taxes withheld from their paychecks that go toward supporting the Social Security and Medicare programs.

For a listing of the types of employees exempt from Social Security taxes see Special Rules for Various Types of Services and Payments in IRS Pub. 7 8 This. To request an exemption from Social Security taxes get Form 4029Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits from the Internal Revenue Service IRS.

In 2020 every dollar of taxable income someone makes above 137700 will effectively be exempt from Social Security taxes. 15 Employers Tax Guide also known as Circular E. It is important to ensure no Social Security wage or tax entry is made on Forms W-2 for exempt individuals.

Then file the form with the Social Security Administration address is on the form. The major exceptions are most civilian federal government employees hired before 1984 they are covered by and pay the 145 tax for Medicare but not for Social Security retirement benefits and about 25 of state and local government employees with a pension plan. You would do the same but multiply by 124 if youre self-employed.

But high-income individuals are exempt from paying the tax on earnings over 142899 for 2021.

Introduction To India S Social Security System India Briefing News

Https Ec Europa Eu Social Blobservlet Docid 15687 Langid En

Income Limit For Maximum Social Security Tax 2021 Financial Samurai

Taxation Of Social Security Benefits Mn House Research

French Social Security And How To Claim Benefits Expatica

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

What Small Business Owners Should Know About Social Security Taxes

How Are Social Security Benefits Taxed

Publication 926 2021 Household Employer S Tax Guide Internal Revenue Service

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

What Is Social Security Tax Calculations Reporting More

What To Do When Excess Social Security Tax Is Withheld Stanfield O Dell Tulsa Cpa Firm

Taxation Of Social Security Benefits Mn House Research

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Fica Tax What Is Fica Tax Rates Exemptions And Calculations

Belgium Payroll And Tax Information And Resources Activpayroll

Post a Comment for "Can An Employee Be Exempt From Social Security Tax"